|

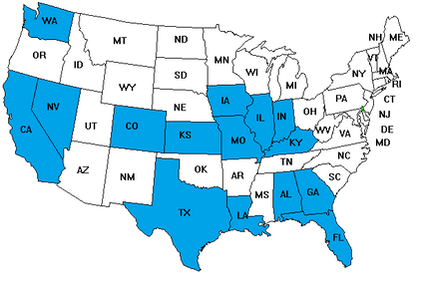

To date, Central States Development Partners have made New Market Tax Credit investments in 15 states representing more than $842 million in total project costs and facilitated a total of 12,676 jobs created and/or retained in the highest distressed areas within low-income communities.

Click below to access our Impact Report. |

Central States Development Partners, Inc. (Central States) is a nationwide Community Development Entity (CDE) that was formed by its parent non-profit, GROWTH, to serve and provide investment capital for low-income communities or low-income persons.

Central States has received six consecutive federal NMTC allocation awards. $60 million received in 2021 Allocation Round $30 million received in 2020 Allocation Round $30 million received in 2019 Allocation Round $35 million received in 2018 Allocation Round $20 million received in 2017 Allocation Round $45 million received in 2015-2016 Allocation Round In addition to its federal NMTC allocations, Central States Development Partners have been awarded State NMTCs as follows: - State of Illinois: Two time allocatee ($4.3 million and $9.7 million respectively) - State of Nevada: Awarded $11.7 million - State of Kentucky: Awarded $3.6 million “When Central States was created in 2009, we knew it would have a remarkable impact to extend our mission further to reach more underserved communities and people. We are proud of the impact we have made to date and are incredibly honored by the CDFI Fund’s support of our work in underserved urban and rural communities throughout the nation,” said Brian Hollenback, President/CEO. Central States has a strong track record, using its prior NMTC allocation awards to support jobs and the provision of services in addition to funding affordable housing and other outcomes over the last five years. |

About New Market Tax Credits

The New Markets Tax Credit program helps economically distressed communities attract private investment capital by providing investors with a federal tax credit. Investments made through the NTMC Program are used to finance businesses and real estate projects, breathing new life into neglected, underserved communities. The NMTC Program catalyzes investment where it’s needed most; over 70% of NMTC investments have been made in highly distressed areas. These are communities with low median incomes and high rates of unemployment, and the NMTC investments can have a dramatic positive impact. For every $1 invested by the Federal government, the NMTC Program generates over $8 of private investment.

In accordance with federal law and the U.S. Department of the Treasury policy, Central States Development Partners, Inc. is prohibited from discriminating on the basis of race, color, national origin, sex, age or disability. To file a complaint of discrimination, write to Department of the Treasury, Office of Civil Rights and Diversity, 1500 Pennsylvania Ave. NW, Washington D.C., 20220 or call (202) 622-1160.